The Joint Declaration between China and France serves as a pivotal milestone, infusing a potent blend of vigor and assurance into Chinese enterprises’ endeavors in the Middle East region. At the invitation of President Macron of France, President Xi Jinping of the People’s Republic of China undertook a state visit to France from May 5th to 7th, 2024. During this diplomatic engagement, the two leaders engaged in profound discussions on the Middle East situation, culminating in the issuance of a “Decalogue Joint Declaration” outlining their shared perspectives on the region’s pressing issues.

As significant outcomes of the tête-à-tête between the leaders of China and France, the Declaration underscores the obligation of both nations, as major global influencers, to actively contribute to the advancement of the Israeli-Palestinian peace process. Synchronized in their approach to Middle Eastern affairs, China and France have articulated a wide-ranging consensus within the Declaration, encompassing their joint stance on the current cycle of Israeli-Palestinian conflict, the Palestinian issue, the Iranian nuclear matter, the crisis in the Red Sea, and their collective aspirations for long-term stability in the Middle East. This manifestation of sagacity and fortitude on the part of the leaders of China and France also resonates with the rightful calls of the international community.

Timely, comprehensive, and purposeful, this Declaration holds paramount significance and far-reaching strategic implications for both the resolution of the current Israeli-Palestinian conflict and the strategic planning for future Israeli-Palestinian peace processes.

Although the recent escalation of the Israeli-Palestinian conflict has yet to directly impact Chinese investments in the Middle East, the persistent nature of this conflict has rendered the political and security landscape of the region increasingly intricate and unstable. Such uncertainties have augmented the risks and challenges faced by Chinese investments in the region. Nonetheless, the Joint Declaration injects a formidable boost of confidence and assurance for Chinese enterprises to persist in their investments in the Middle East.

China’s investment ventures in the Middle East span across diverse sectors, encompassing energy, infrastructure, mining, agriculture, services, fine chemicals, education technology, and desalination projects.

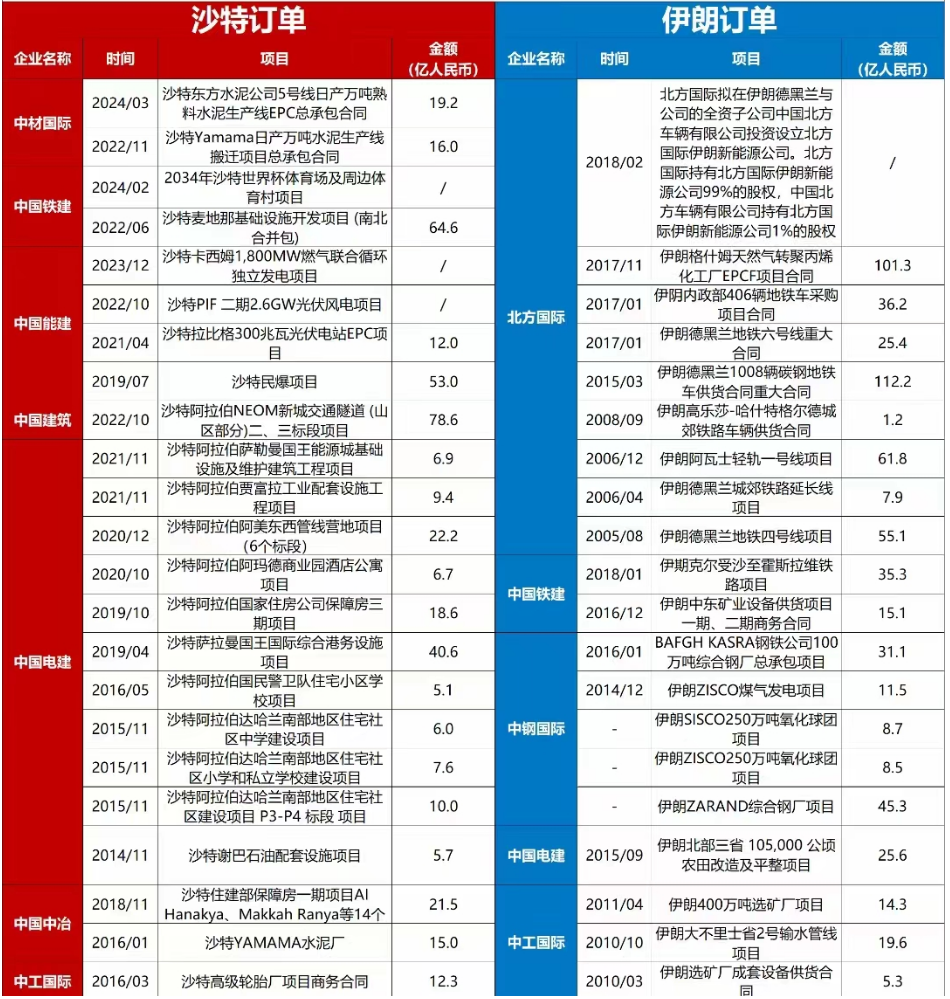

Central Enterprises’ Saudi and Iran Project Order Review:

The energy and chemical sectors have witnessed a burgeoning collaboration between Chinese enterprises and Middle Eastern countries, particularly Saudi Arabia, since October 2023:

On October 23, 2023, during the 7th Saudi Future Investment Initiative Summit, Sinopec and Saudi Aramco inked a memorandum of understanding for the “Yanbu Refinery+” project. This significant petrochemical project entails the conversion of liquid feedstock into chemical products, including the construction of a new 1.8 million tons/year ethylene cracking unit and downstream derivative units. It aims to synergize deeply with China’s largest investment project in Saudi Arabia, the Yanbu Refinery project.

On January 2, 2024, Rongsheng Petrochemical and Saudi Aramco signed a memorandum of understanding in Dharan, Saudi Arabia. According to this memorandum, both parties intend to acquire stakes in each other’s subsidiaries. The memorandum indicates discussions regarding Rongsheng Petrochemical (or its affiliates) acquiring a 50% stake in Saudi Aramco’s Jubail Refinery Company (“SASREF”) and plans to expand refining and petrochemical capacity, enhance product flexibility, complexity, and quality.

On April 21, 2024, Rongsheng Petrochemical and Saudi Aramco signed a “Cooperation Framework Agreement” to jointly explore the joint operation of Rongsheng Petrochemical’s wholly-owned subsidiary, Ningbo Zhongjin Petrochemical Co., Ltd. (“Zhongjin Petrochemical”), and Saudi Aramco’s wholly-owned subsidiary, SASREF, laying the groundwork for significant investments in China and the Kingdom of Saudi Arabia.

The Middle East remains one of the most promising markets for Chinese companies in the future.

The road may be winding, but the future is bright. The Middle East has always been one of the key investment areas for Chinese companies. It is believed that temporary difficulties will not dampen the enthusiasm and confidence of Chinese enterprises in investing in the Middle East. This confidence stems from the economic environment, market conditions, labor situation, legal regulations, and tax standards, all of which indicate that the Middle East remains the most promising market in the future.

Taking Saudi Arabia as an example, let’s examine the business environment:

From an economic perspective, although Saudi Arabia became one of the fastest-growing economies globally in 2022, its manufacturing GDP proportion remains relatively low compared to other countries, suggesting significant potential for improvement.

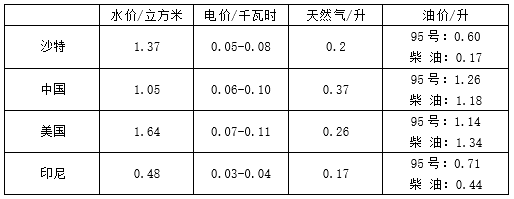

In terms of market environment, Saudi Arabia’s electricity and natural gas prices are lower than those in China, the United States, and other countries, while oil prices are significantly lower than in other countries. Gasoline and diesel prices are only half or one-third of those in other countries, presenting evident cost advantages in transportation and certain industrial production.

Comparison of water, electricity, gas, and oil prices between Saudi Arabia, China, the United States, and Indonesia.

Note: All prices are in USD. The prices for water, electricity, and gas are based on the average industrial prices for the year 2021. The oil price is as of September 30, 2022. Exchange rates are based on the real-time rates as of September 30, 2022.

Data sources: Ministry of Commerce’s Guide to Foreign Investment and Cooperation by Country 2021 Edition, MarketWatch, etc.

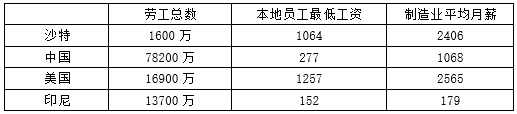

From the labor perspective, as of the end of 2022, Saudi Arabia had a total workforce of approximately 16 million people, with 11 million being foreign workers. The minimum wage requirement applies only to local Saudi employees. Additionally, Saudi Arabia ranks third in the world for employing Indonesian migrant workers, following Malaysia and Taiwan.

Comparison of labor statistics, minimum wages for local employees, and average monthly salaries in the manufacturing industry in Saudi Arabia, China, the United States, and Indonesia.

Please note: currency is in USD.

Data sources: Ministry of Commerce’s 2021 Guide to Foreign Investment and Cooperation by Country, Saudi Arabian National Labor Bureau, among others.

Post-Analysis of Business Environment in Saudi Arabia

Legally speaking, in 2022, Saudi Arabia enacted a new Companies Law, which governs all forms of entities in the Saudi market, whether commercial, non-profit, family-owned, or professional, under this comprehensive single law.

Under the new Companies Law, foreign companies are required to conduct their business activities within Saudi territory in accordance with the Foreign Investment Law and other relevant laws and regulations, either through branch offices, representative offices, or any other forms.

Typically, foreign enterprises intending to establish commercial entities in Saudi Arabia must obtain a Foreign Investment License from the Ministry of Investment, and if the application meets all requirements, the General Investment Authority usually issues the Foreign Investment License within four weeks. It’s worth noting that when establishing a business in Saudi Arabia, foreign investors must provide at least one year of audited shareholder financial statements to demonstrate experience in the relevant field.

In terms of tax standards, establishing a company in Saudi Arabia entails payment of corporate income tax, social insurance contributions, customs duties, value-added tax, excise tax, and property tax, with particular attention to Saudi Arabia not imposing personal income tax.

The sources of data include PricewaterhouseCoopers (PWC), among others.

From the perspective of foreign trade and economic cooperation, Saudi Arabia is situated at the intersection of Asia, Europe, and Africa, and is positioned at the core node of the “Belt and Road” initiative. It is in close proximity to markets with a combined population of over 3 billion people, making it a crucial foothold for Chinese enterprises to expand into the global market in the future.

Sources: Publicly available data, government documents, EY, among others.

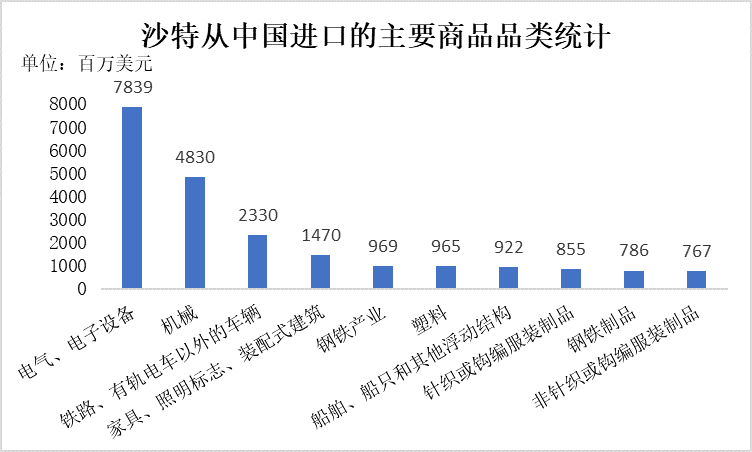

From the perspective of import trade, China emerged as Saudi Arabia’s largest source of imports in 2021. Analysis of the categories of goods imported from China reveals a diverse array, including electrical and electronic equipment, machinery, vehicles excluding railway and tramway, furniture, lighting signs, prefabricated buildings, steel industry materials, plastics, ships, boats, and other floating structures, knitted or crocheted clothing articles, iron and steel products, and non-knitted or crocheted clothing articles, among others.

From a financial perspective, Saudi Arabia lacks specific legislation regarding foreign exchange management, and there are no foreign exchange controls in place for both residents and non-residents in terms of capital income and payments.

Sources: Official governmental portals, with currency exchange data up to December 31,2022.

Escalating Israel-Palestine Conflict Impacts Multiple Countries and Regions in the Middle East, Significantly Affecting Global Economy

Since the outbreak of the latest Israel-Palestine conflict on October 7,2023, it has spread to several countries and regions in the Middle East, including Lebanon, Iran, and others.

The turmoil in the Middle East has brought disaster to the local population and has had far-reaching effects on the global economy. The impact is manifold, involving energy, geopolitics, investor confidence, trade, and supply chains, among other aspects.

The Middle East is a crucial global energy supplier, especially for oil. When tensions or conflicts arise in the region, markets become concerned about the stability of oil supply, leading to an increase in oil prices.

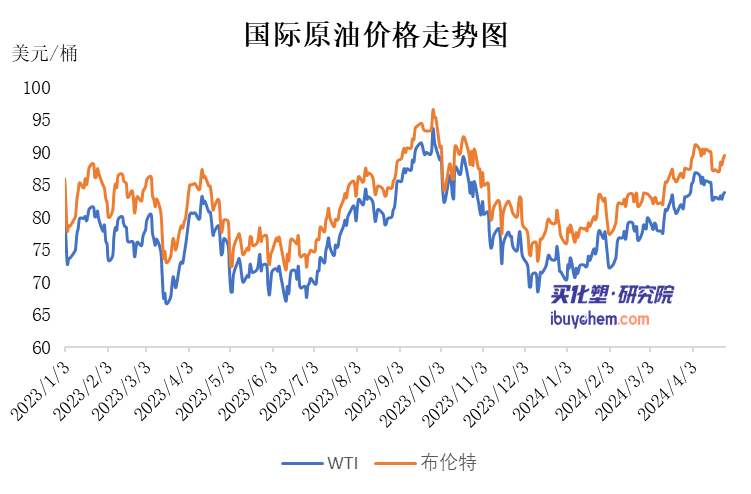

From the trend chart above, it can be observed that since the outbreak of the latest Israel-Palestine conflict, international crude oil has experienced fluctuating increases, essentially maintaining a high level of around $80 per barrel. This rise not only affects the energy industry but also impacts other sectors through cost transmission mechanisms, thereby exerting a widespread influence on the global economy.

The Middle East issue is complex and intricate, requiring consensus and concerted efforts from the international community to alleviate the current regional tensions. The joint statement on the Middle East situation issued by the heads of state of China and France holds significant importance. It not only demonstrates the pragmatic outcomes of the discussions between the two leaders but also reflects and consolidates the broad consensus of the international community on peace in the Middle East. The China-France joint statement will contribute significantly to advancing the Israeli-Palestinian peace process and maintaining world peace and stability, injecting strong impetus and confidence into the construction of a community with a shared future for mankind.