HZ Info: Recently, with the release of real estate construction data for 2023 and the gradual clarification of construction investment trends, the waterproof material market has also ushered in new opportunities and challenges. Follow the perspective of HZ Info to glimpse the potential direction of the waterproof material market in 2024.

As an essential functional building material in modern architecture, building waterproofing materials play a crucial role in real estate, infrastructure construction, and other fields. According to data from the Building Waterproofing Association, the demand for waterproofing materials in real estate accounts for 60-70% of building construction, and real estate remains the “leader” of waterproofing enterprises.

The trend of market development is closely related to the overall economic environment. To some extent, it also reflects the trend and context of economic development. HZ Info will analyze the future development trends of the waterproofing industry from real estate data, annual production of building waterproofing materials, investment in the construction industry, and future market trends.

ⅠIn 2023, China’s real estate industry will be affected by multiple factors, and the future is still not optimistic.

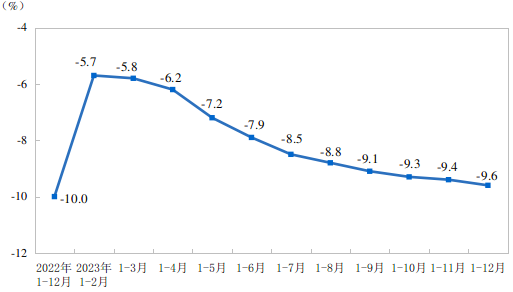

In 2023, China’s real estate development investment was 11091.3 billion yuan, a decrease of 9.6% compared to the previous year; Among them, residential investment was 8382 billion yuan, a decrease of 9.3%.

The decline in real estate development investment across the country, especially residential investment, has been influenced by multiple factors such as policy regulation, financing pressure, and economic environment. For example, the government’s regulatory policies on the real estate market place more emphasis on the residential properties of housing, limiting speculative home purchases, which to some extent affects the growth of residential investment. In addition, with the gradual rise of the rental market, some investors are starting to shift their focus, which may also have a certain impact on residential investment.

China’s Real Estate Development Investment Growth Rate

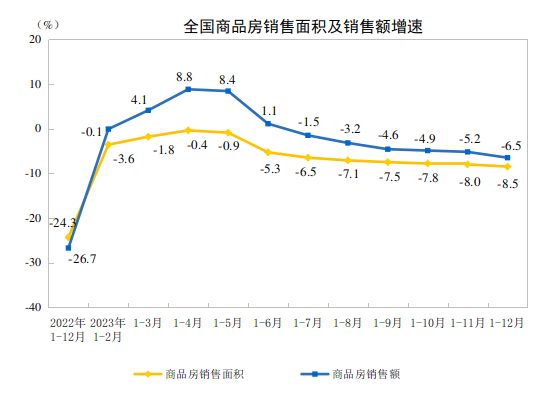

In 2023, the overall sales of the real estate industry were sluggish, and the sales receipts of real estate companies were sluggish. In addition to private real estate companies, some mixed ownership real estate companies also experienced cash flow shortages. The real estate market has shown a trend of “high, medium, low, and stable”. Since the second quarter, the real estate market has rapidly turned cold, and the performance of the “golden nine silver ten” real estate market has not been as expected, resulting in insufficient overall recovery momentum. In 2023, the weak sales in the real estate market and cautious land acquisition by real estate companies have dragged down the economic recovery and local finances as the largest pillar industry. Although the policy environment continues to be relaxed, due to various factors, the real estate market has not shown a significant rebound.

Some industry insiders also predict that in 2024, the newly started construction area of real estate development enterprises in China is expected to decrease by 5%. The decrease in new construction area may lead to a corresponding decrease in market demand for waterproofing materials.

Firstly, various financial policies will further support and guarantee the work of real estate enterprises, helping them alleviate financial pressure. But some policies may lead to an increase in the cost of funds for real estate companies, so when choosing waterproof materials, real estate companies will also be more strict about prices.

The second is to promote the work of ensuring the delivery of buildings in various regions, accelerating the pace of work from the perspective of safeguarding and stabilizing people’s livelihoods. This also provides certain opportunities for waterproofing enterprises to strengthen cooperation with real estate enterprises and meet the work needs of ensuring the delivery of buildings.

Ⅱ The number of enterprises above designated size has increased, but the total output has declined for the first time.

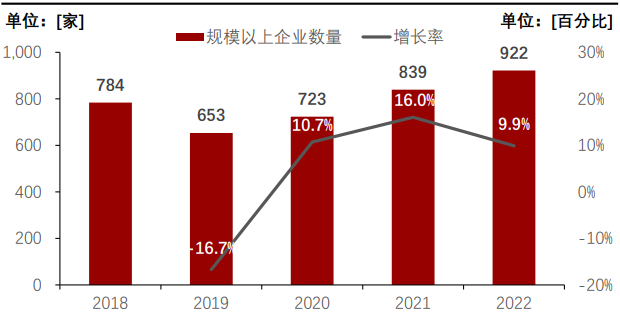

It is understood that as of 2022, due to the expansion of local small and medium-sized enterprises in building materials and the development of waterproof material businesses, the number of large-scale building waterproof materials has reached 922.

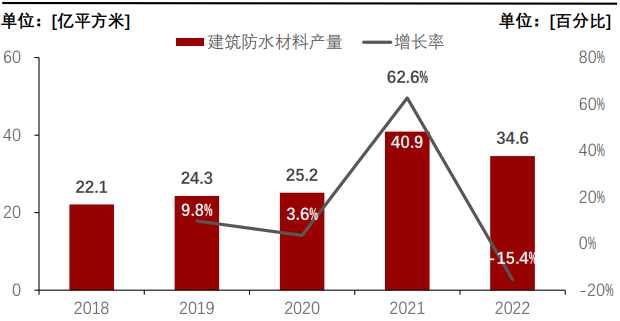

Based on the decrease in demand for construction projects in the construction industry, the total production of building waterproofing materials in 2022 was 3.46 billion square meters, a year-on-year decrease of 15.6%, marking the first decline in ten years.

Production and Growth Rate of Building Waterproofing Materials in China (2018-2022)

From the data, it can be seen that the construction waterproofing material industry has seen an increase in the number of enterprises above designated size but a decrease in total output. Mainly in recent years, due to the impact of the epidemic, the pressure on real estate demand, the rise of raw materials, and the spread of credit risks, the development of construction enterprises has been affected to a certain extent. In the future, with the improvement of new infrastructure, photovoltaics, residential quality, and living comfort, concepts such as smart homes and smart buildings will gradually become popular. This will encourage waterproof material enterprises to continuously innovate and develop products that better meet the needs of intelligence.

Ⅲ Prediction and Market Outlook of Investment in the Construction Industry

According to industry estimates, the market space for the four major areas of housing construction, infrastructure, repair (only including roof repair, excluding old renovations), and photovoltaic roofs is 81.5 billion yuan, 60 billion yuan, 30 billion yuan, and 5 billion yuan, respectively.

The growth momentum in the four major areas is strong, especially in the infrastructure and repair markets, benefiting from policy support and market demand, maintaining a stable growth trend. At the same time, the new energy market continues to expand, and the photovoltaic rooftop market also shows enormous potential. The demand for waterproofing materials in these fields will continue to increase, once again providing development space for the waterproofing industry.

The waterproofing market space in the infrastructure sector is approximately 60 billion yuan. With the implementation of new waterproofing regulations, the construction sector will become the main source of increment. According to the statistics of the Building Waterproofing Association, the demand for waterproofing materials in the fields of building construction, infrastructure, and urban renewal accounts for 40%, 40%, and 20%, respectively. According to data from 2022, the waterproofing market space in the infrastructure sector is approximately 55.2 billion yuan.

The market space for rooftop photovoltaic waterproofing is approximately 5 billion yuan. According to data from the National Bureau of Statistics and calculations from the Chinese Academy of Building Sciences, China currently has an existing building area of about 80 billion square meters, with an annual increase of nearly 100 million square meters of roof area for daylighting tiles. Based on the material cost of TPO waterproofing membrane at 40-50 yuan/square meter, the annual increase in market space is about 5 billion yuan.

According to data from the Ministry of Housing and Urban Rural Development, in 2023, 76000 kilometers of aging pipelines such as water, electricity, and heat will be newly renovated in various regions, 36000 elevators will be installed, 116 million square meters of building energy-saving renovation will be implemented, 85000 parking spaces, 36600 electric vehicle charging stations, 288000 electric bicycle charging stations will be added, 21000 community service facilities such as elderly care and childcare will be added, and 6.37 million square meters of cultural and leisure, sports and fitness venues will be added.

The future development of investment in the construction industry, especially in areas such as housing construction, infrastructure, roof repair, and photovoltaic roofs, requires us as “waterproof people” to consider from multiple dimensions:

First is the sustained and stable growth of the national economy, as well as the continuous relaxation of relevant policies. In terms of infrastructure investment, the government’s attention and investment in the infrastructure industry are expected to achieve significant growth in infrastructure investment.

Secondly, in the field of housing construction, with the acceleration of urbanization and the improvement of residents’ living standards, the demand for housing is becoming increasingly strong and sustained.

Thirdly, in the roof repair market, although its market size is relatively small, with the aging of buildings and the increasing demand for maintenance, the market in this field is gradually expanding.

Fourthly, as an emerging green building technology, photovoltaic roofs have broad market prospects. With increasing support from the government for renewable energy and green buildings, investment in the field of photovoltaic roofs is expected to achieve rapid growth.

From the current development, infrastructure investment may occupy a larger market share, and the fields of housing construction, roof repair, and photovoltaic roofs will also develop steadily, providing commercial opportunities for related industries such as waterproofing materials. At the same time, with the advancement of technology and the increasing maturity of the market, waterproof enterprises also need to closely follow the development track and seek a new driving force for development.